child tax credit october 2021

Thats an increase from the regular child tax. Half of the total is being paid as six.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty researchers.

. For each child ages 6 to 16 its increased from 2000 to 3000. With families set to receive 300 for each child under 6 and 250 for each. 150000 if you are.

Six payments of the Child Tax Credit were and are due this year. October 14 2021 726 AM MoneyWatch. The changes in 2021 increased the credit to 3600 per child under six and 3000 for each child six to 17.

That drops to 3000 for each child ages six through 17. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. The Child Tax Credit reached 611 million children in.

IR-2021-201 October 15 2021. Families with children under 6 years old will receive 300 per child. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

The IRS began sending out the fourth of six monthly child tax credit payments on Friday 15 October. Visit ChildTaxCreditgov for details. Families will receive a.

It also now makes 17-year-olds. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Recipients can claim up to 1800 per child under six this year split into the six payments.

1052 AM PDT October 15 2021 The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. Those with children ages 6 to 17 can expect 250 per child. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

So parents of a child under six receive 300 per month and parents of a child six or over. It has gone from 2000 per child in 2020 to 3600 for each child under age 6. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per.

This summer the Biden-Harris administrations American Rescue Plan Act increased the 2021 Child Tax Credit CTC. With only four more payments hitting bank accounts this year parents who want to receive the child tax credit need to register by October 15 Credit. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Individuals earning less than 75000 and. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The IRS is paying 3600 total per child to parents of children up to five years of age.

The deadline to sign up. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

The next advance Child Tax Credit payment goes out later this week with direct deposits arriving almost immediately and mailed checks taking a little longer. Six payments of the Child Tax Credit were and are due this year. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December.

This historic support the largest ever credit.

The Child Tax Credit Toolkit The White House

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Child Tax Credit 2022 Are You Eligible For Money From Your State Cnet

The Child Tax Credit Toolkit The White House

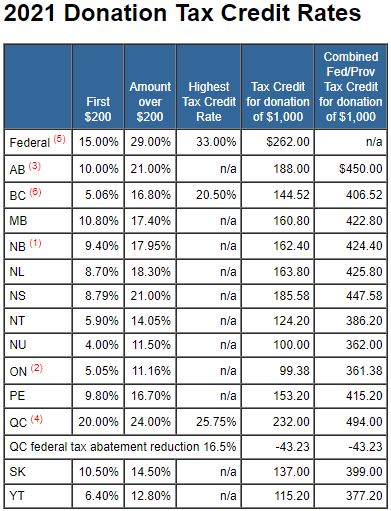

Taxtips Ca Donation Tax Credit Rates For 2021

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Childctc The Child Tax Credit The White House

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

2021 Child Tax Credit Advanced Payment Option Tas

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor